ASIC recently reviewed the superannuation sector and found super funds and financial advisers could do more to monitor investments in super and communicate with members and clients about how their super is performing.

These findings follow research ASIC conducted in late 2023 that found almost 3 in 10 Australians only check their super’s performance once a year or have never checked it.

That’s why we’re encouraging people to take a greater interest in their super.

How your super is invested

If your super is getting paid into the super fund your employer chose for you, then chances are you have a MySuper account.

MySuper accounts generally have low fees and a balanced investment strategy that aims to grow your investments in super over your working life.

Super funds also offer a range of ways to invest your money in super, including pre-mixed investment options in assets such as shares and property. These investment options are called ‘choice’ super products because you’re actively making a choice about where your super is invested, rather than going with the default MySuper option. Sometimes the choice is recommended by a financial adviser if you have one.

Investments in super impact your future lifestyle

When you’re leading a busy life, it isn’t always front of mind to check your super performance. But committing a small amount of time to regularly review your investments in super can have a big impact over time.

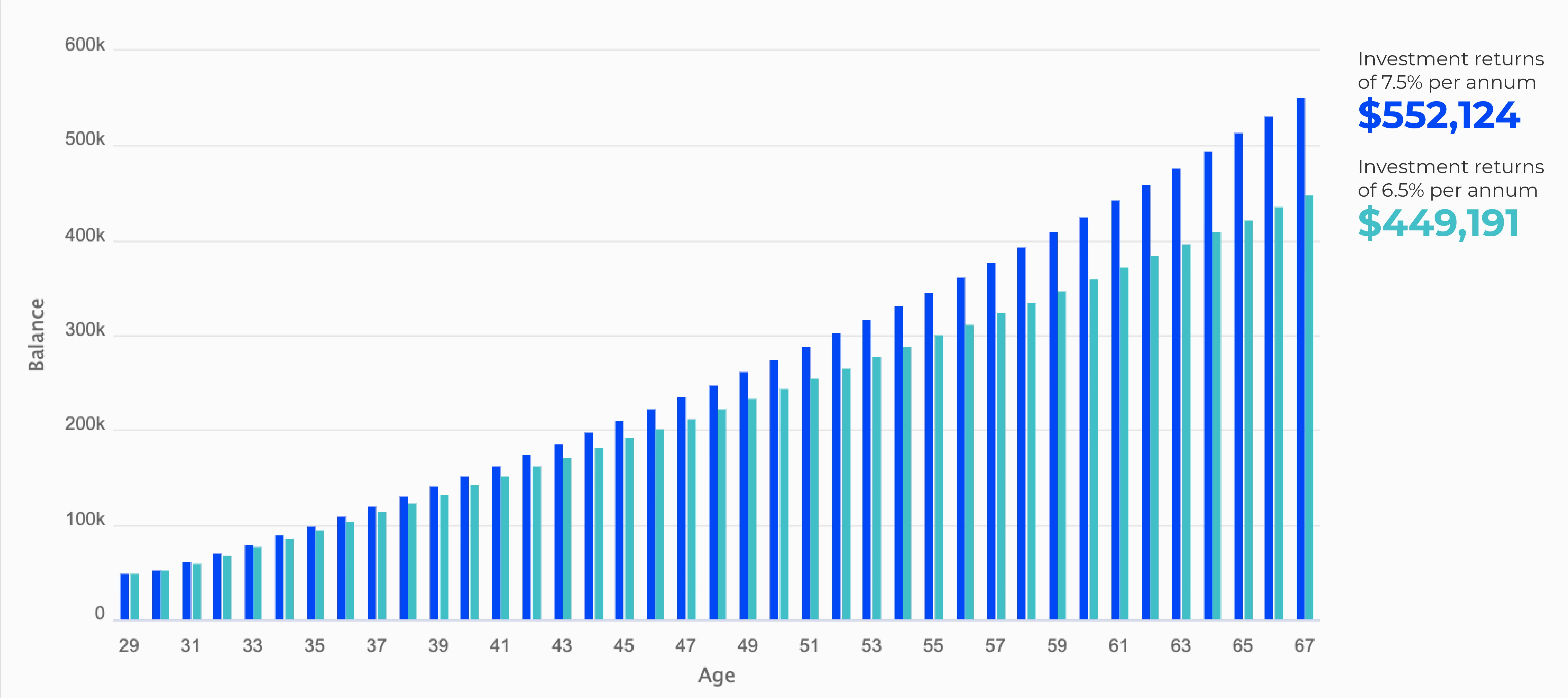

Using Moneysmart's superannuation calculator, the chart below compares a super fund’s investment option that achieves average investment returns of 7.5% per annum to one that returns 6.5% per annum for someone 30 years old. It doesn’t sound like much, but a 1% difference over a lifetime equals over 20% more super at retirement. That could be the difference between whether you can travel, enjoy going out with friends and the aged care you can afford.

The impact of one percent more investment returns over time

Make the most of your super

Here are three things you can do to make sure you are getting the most from your super.

- Get to know your super. You can do this on your fund’s website, app or by calling them and asking questions. Find out how your super is currently invested, insurance options and other features your fund offers and compare it to others.

- Don't set and forget. Regularly check how your investments in super are tracking against their targets and consider whether you are in the best investment option for you. See our tips on choosing a super fund.

- If you have a financial adviser, ask them how your super is performing, including performance over the short and long term, and whether you're on track to meet your retirement goals. Ask if there are better options and if there are any tax or insurance consequences if you make a change.

How you approach your super is a personal choice but if you put yourself in an informed position, you will be better placed to make financial decisions about your retirement savings.

Don't let your superannuation be an afterthought – take charge of your financial future today.

Text version: Get more from your super

Superannuation is one of the largest and most important investments many Australians will ever hold.

1. Don't set and forget

Get to know your super fund and all they offer by visiting its website or app and calling them to ask questions.

2. Check your investments

Regularly check your investments are performing against their targets.

3. Ask your financial adviser how your super is performing

If you have an adviser, ask them how your super is performing compared to your long term goals.

4. Compare investment options

Investment performance can vary, so keep an eye out for how your investment compares to other options.